In Kazakhstan, gasoline prices have increased sharply. What affects the rise in fuel prices and will gasoline continue to become more expensive?

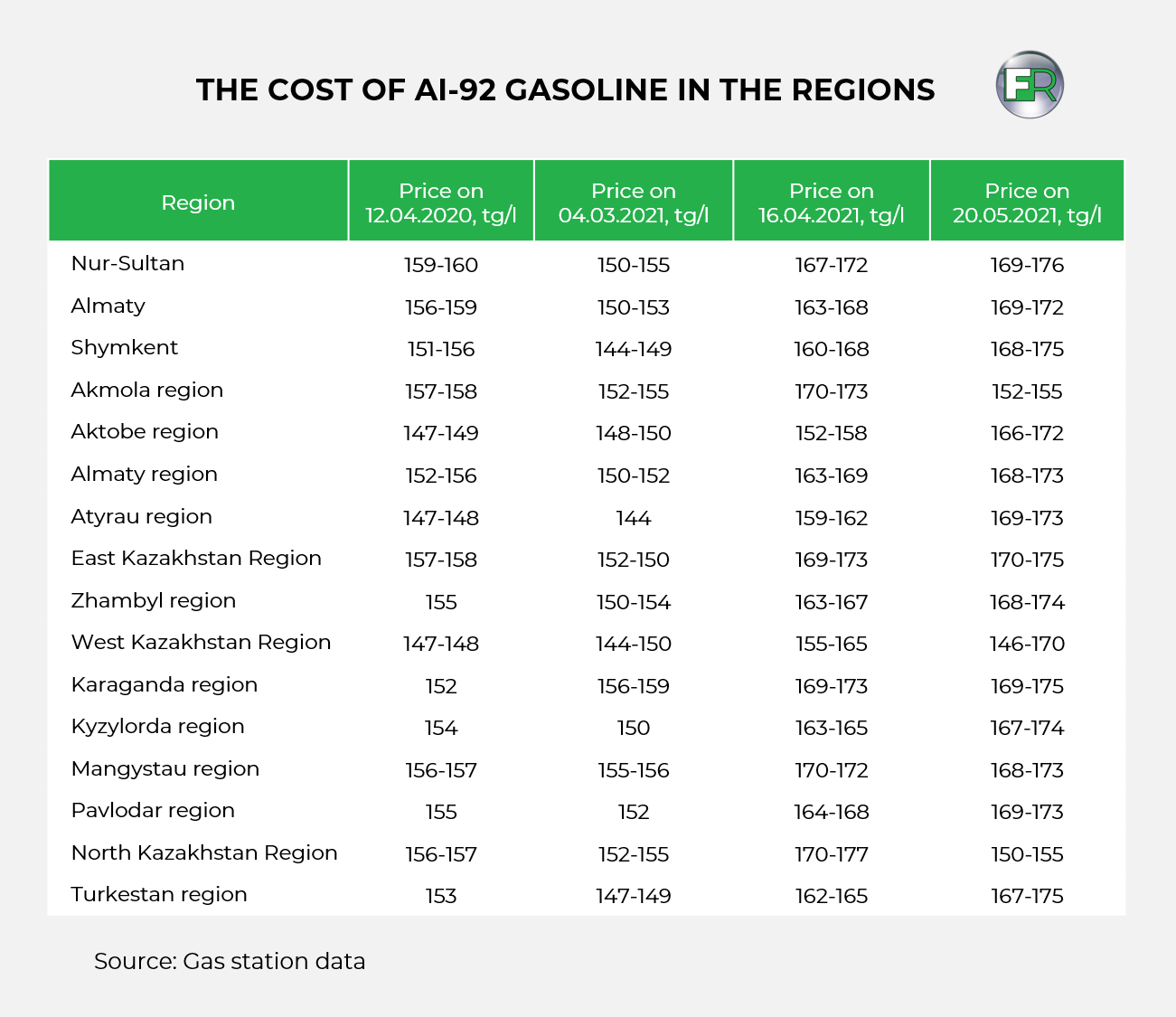

Gasoline at Kazakhstan’s gas stations began to gradually become more expensive from March 2021. For example, in the city of Nur-Sultan, the average price for the most popular AI-92 fuel has now increased from 150 to 176 tenge per liter.

Analysts finreview.kz we found out why fuel prices are rising and whether gasoline will continue to rise in price.

To begin with, let’s understand what the cost of gasoline is formed from.

Gasoline pricing

After the modernization of oil refineries in 2018, Kazakhstan’s producers were able to fully cover domestic demand for fuel for the first time in a long time. Now the refineries are able to produce 24% more gasoline than the market needs, and the nearest fuel shortage will occur no earlier than 2032. Of course, this is a significant event for the oil and gas sector of the country, as the import of expensive gasoline has decreased by 32 times.

Accordingly, according to logic, Kazakhstan can independently form the cost of fuel in the domestic market, providing the country with cheap gasoline. However, in reality, not everything is so simple — while the price of oil in the last three years fluctuated within significant limits, falling and increasing, the price of gasoline gradually changed, sharply rising in price only in October 2017.

The reason is that oil companies supply the domestic market from 30% to 50% of oil at cost, namely in the range of 25-30 US dollars per barrel. The retail price of gasoline is formed from its wholesale price at the refinery, taking into account all the associated costs of delivery from the plant to the gas station — storage at the oil depot, operating expenses, taxes, banking services, VAT, wages, the margin of the giver, etc. At the same time, the share of oil in pricing is only 11% -14%, and the margin or net profit of gas stations reaches only 1-3 tenge per liter. That is, in fact, enterprises earn from the high demand of the domestic market for gasoline.

Now let’s look at the main reasons for the rise in the price of gasoline:

Firstly, the start of sales on the commodity exchange leads to the harmonization of the fuel market

The launch of gasoline trading on the ETS commodity exchange was carried out as part of the development of the centralized trading infrastructure and the transition of the fuel and energy sector to a market economy. At the initial stage, about 10% of the gasoline produced in the country will be sold through the exchange. In the future, its volume will be increased to 15% -20%.

Since the beginning of the first session, the auction has shown a high demand from market participants. During the first seven sessions, 19 thousand tons of AI-92 and AI-95 gasoline were sold. The total turnover for this fuel amounted to more than 4 billion tenge.

As a result, the first price indicators for gasoline were formed. For the entire trading week, the cost of fuel increased by 39% from the starting price of 169 thousand tenge to 234.9 thousand tenge per ton. That is, from 125 to 174 tenge per liter. During the last trading session, which took place on April 12, the price of AI-92 ranged from 155 to 174 tenge per liter.

Accordingly, the retail price at gas stations also increased.

Secondly, repair work at oil refineries threatens the country with a shortage of gasoline

Repairs at the Atyrau refinery began due to a failure in the supply of electricity, which led to an emergency shutdown of some technological installations. The unscheduled suspension of production caused an extreme shortage of fuel reserves in the West Kazakhstan region, and the resulting hype increased the shortage of gasoline and led to an increase in retail prices in the region.

In order to provide the domestic market with fuel, the planned major repairs at the Pavlodar and Shymkent plants were postponed to a later date. Nevertheless, these works will be carried out this year, which poses the threat of a larger shortage of stocks.

Thirdly, gasoline pricing is formed from the supply/demand ratio

State regulation of fuel prices was in effect until 2015. Initially, the administrative control measures consisted of directly determining the selling prices for fuel, but since 2011 they have been limited to setting an upper limit, that is, the maximum cost of gasoline. These measures were abolished in the middle of the last decade, and the market went into free float, while remaining under some state supervision. For example, oil supplies to refineries are still carried out at cost, and not at the market price.

In turn, the free float of the market means that the final value is formed by the volume of demand and the volume of supply. The state no longer intervenes in this process and does not subsidize this area.

Fourthly, the single market of oil and petroleum products within the EAEU should be operational by 2025

The creation of a common market for oil and petroleum products will increase the availability of energy resources for the EAEU member states and expand the sales market for domestic producers. As a result, the cost of gasoline in the region will be equalized. However, for Kazakhstan, this means an increase in the cost, since the country has the lowest prices among the EAEU countries. In particular, in Russia, the price of AI-92 is about 250 tenge per liter. Accordingly, the cost of gasoline can increase by 50%.

Thus, these are the four main reasons for the rise in the price of gasoline. But the question remains what exactly Kazakhstan needs to do to curb prices and develop the oil and gas sector. One of these tools can be investments in oil refining.

Investments in oil refining will help reduce the cost of gasoline

Gasoline is a socially significant product, and its price affects the pricing of other goods. That is, the increase in prices will cause a decrease in the consumer capacity of the population, which has a negative effect on the economy.

Therefore, the development of the oil and gas sector is a strategically important task for the country. However, to increase industrial production, monetary investments are necessary. Working capital allocated to increase production capacity by 40% as of the end of April 2021 consisted of loans from the banking and non-banking sectors. It is obvious that this indebtedness of enterprises is reflected in the cost of gasoline, making the market vulnerable to any local and external factors.

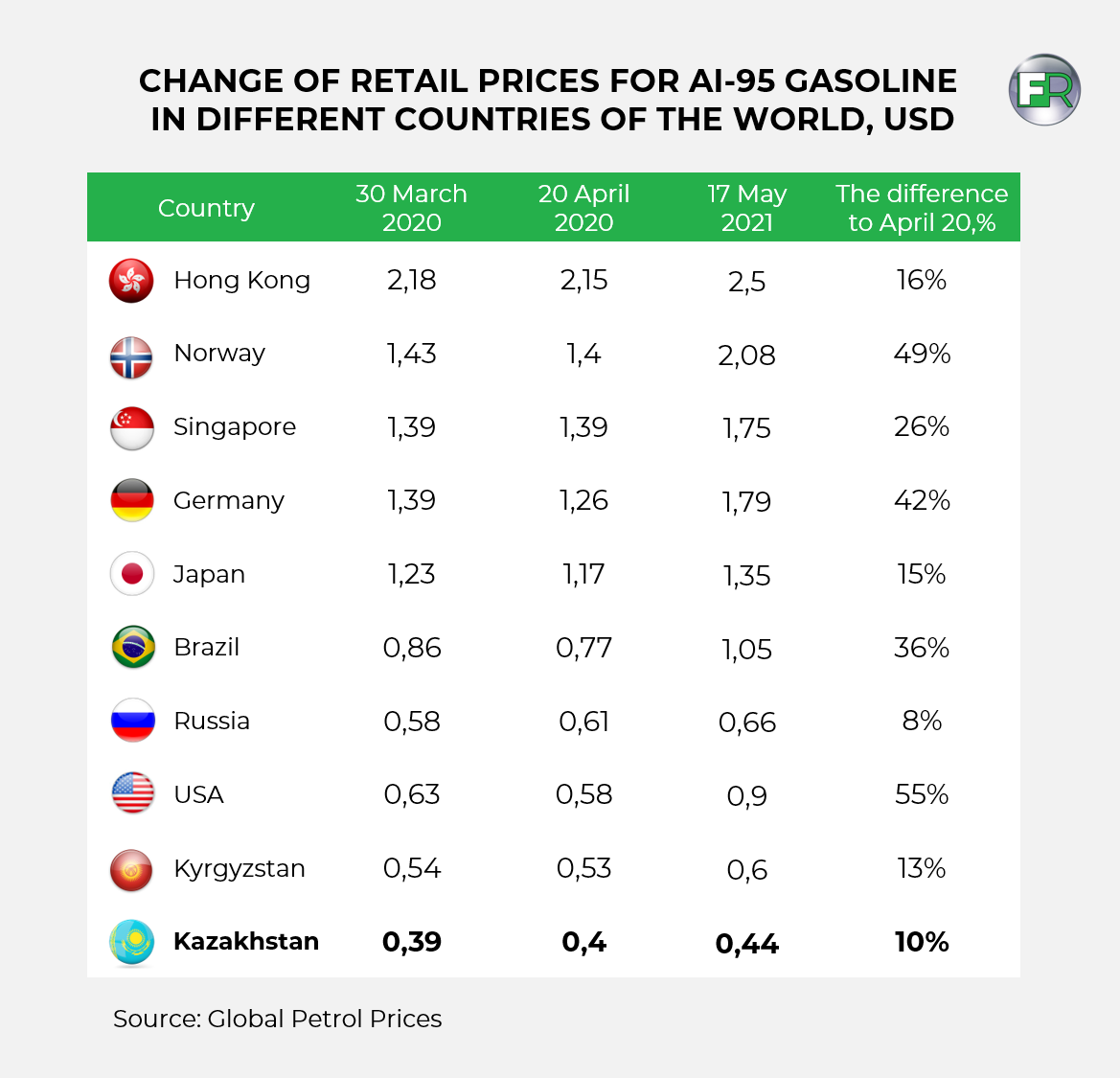

In this situation, Kazakhstan needs to reduce the impact of the credit burden on the cost of motor fuel. It is possible to achieve this result by attracting investment funds that will allow domestic refineries not only to increase capital, but also to increase production, thanks to the expansion of the geography of fuel sales to foreign markets. Moreover, the cost of gasoline in the country remains one of the lowest in the world, which means that its export represents a significant benefit for investors.