- Main

- Investment

- Septmeber 2022 AIX Market Overview

Issuers, Brokers, Accounts

As of the end of September 2022, 129 issues of securities from 88 different issuers, including 19 ETNs (Exchange Traded Notes), were in the official AIX list. AIX trading members are 17 Kazakhstan’s brokers and 12 international brokers. More than 415,000 investor accounts were opened with the AIX Central Securities Depository.

In September, AIX confirmed the compliance of its activities with the global standards ISO 27001 and ISO 27032 and passed additional certification under two new standards — ISO 27018 and ISO 27017. These standards cover the adherence of AIX to the full business cycle of its operations: trading, clearance, settlement, registration, and depository services.

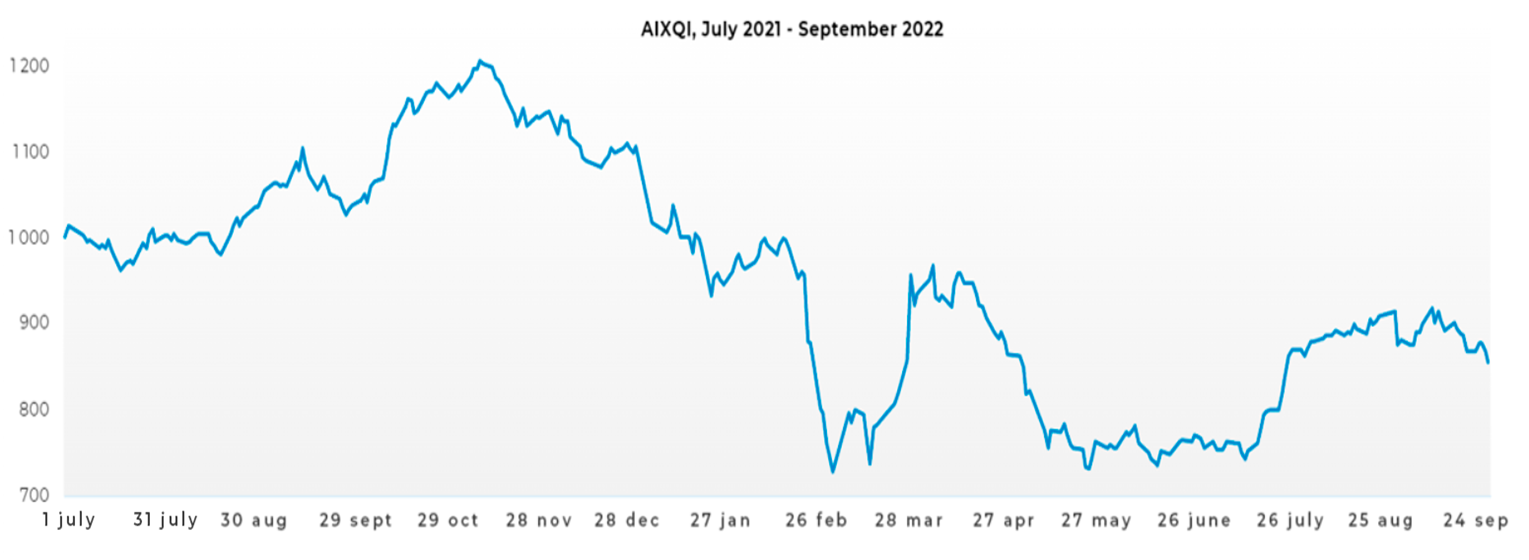

AIX Qazaq Index

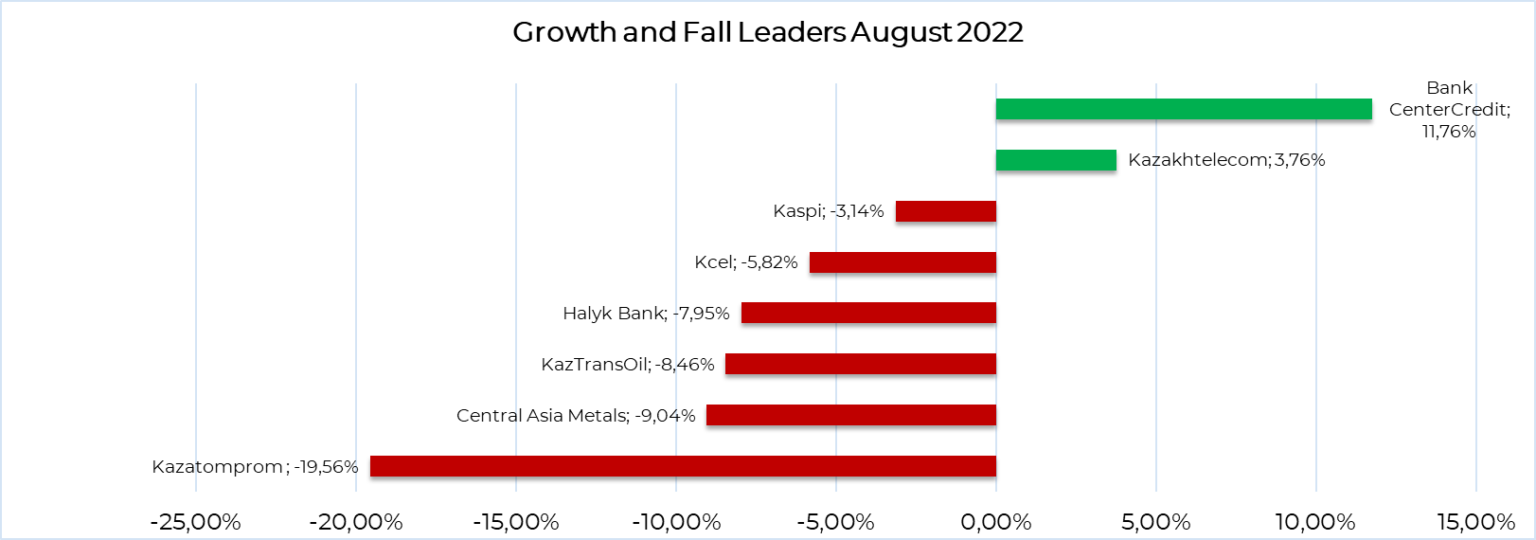

In general, AIXQI showed an increase of 11.67% over Q3 2022. Three index companies posted a a strong quarterly growth : Kcell (+40.6), Bank CenterCredit (+37.9%) and Kaspi.kz (+33.7%).

For Kcell shares, Q3 2022 was a period of recovery in value, which earlier had declined significantly due to the decision of the company to postpone the payment of dividends. The convincing performance of the telecom operator set up the foundation for steady increase over almost the entire quarter. According to the company’s financial statements , Kcell net profit per share almost doubled in 2021, and keeps on growing in 2022. In September, Kcell shares adjusted by 5.82%. One of Kcell key shareholders – Kazakhtelecom – routinely tends to minor market fluctuations in quotations – by the end of September, the company’s shares increased by 3.76%, and quarterly growth was 7.19%.

In 2022, the robust financial statements published by Bank CenterCredit and the successful merger with Alfa-Bank subsidiary supported the sustained rally of i the bank’s share price. BCC shares grew by 11.76% in September. The improved business position of the bank was marked by S&P that upgraded BCC long-term credit rating from “B” to “B+” with a Stable outlook.

Another banking sector player demonstrated strong financial performance as well – Kaspi.kz. In addition, Kaspi.kz share prices are positively supported by GDR repurchased and dividends paid (500 KZT per ordinary share). S&P upgraded Kaspi Bank ratings from “BB-“ to “BB” with a Stable outlook. After that increase during most of Q3 2022, Kaspi.kz share price adjusted downwards by 3.14% in September.

Although on September 19, Halyk Bank announced its plans at the General Meeting of Shareholders to make a decision on dividend payment in October as well as the potential payment of dividends on ordinary shares, the shares of Kazakhstan’s leading bank fell by 7.95% at the end of the month. However, Halyk Bank closed Q3 with an overall increase of +3.63%.

Kazatomprom Board of Directors approved the Company’s strategy to reduce production in 2024 by about 10% compared to the initial planned level. Also in September, some personnel changes occurred in the top management of the uranium company – Mr. Y. Mukanov was appointed the Chairperson of the Board and the position of Chief Strategy and Development Director was suppressed from the company’s top management organization . As a result, the number of Board members reduced from 8 to 7. Kazatomprom shares lost in value (-19.56%) in September, leading to a quarterly decline of 1.32%.

KazTransOil shares were under pressure amid the decline in oil prices in September. At the end of the month, KTO share prices decreased by 8.46%, but still posted a quarterly increase of 0.58%.

Central Asia Metals displayed the worst result among the AIXQI companies by the end of the quarter (-4.77%) following the general trend of developed countries, recession expectations and tightening of monetary policy by the Bank of England. By the end of September, the company’s shares fell by 9.04%.